Global equity markets have been very strong with the MSCI World ex Australia up 23.21 per cent to the end of September, led by the S&P 500 which is up 30.54 per cent over the same period.

What many forget is that the S&P 500 bottomed out in October 2023 after having fallen 8.84 per cent in the three months prior.

Prior to this bottoming out sentiment towards the US was very negative, with much debate over when US interest rates will fall and whether a recession was imminent. Capital Economics in London were looking at GDP growth for both the US and Europe of 1.5 per cent at the beginning of 2024.

Today the Atlanta Fed GDP NOW estimate sits at 2.8% growth for the US and Europe looks like it will be flat or zero.

The US economy has been incredibly strong, with a recession widely flagged but which has not occurred. In fact, we describe the market rally as a ‘hated rally’, as many did not focus on the downward direction of interest rates from their peak and the underlying growth in the US economy.

Furthermore, the first six months of the rally was dominated and still is in a sense by the Magnificent Seven and was led through exposure to Artificial Intelligence or AI.

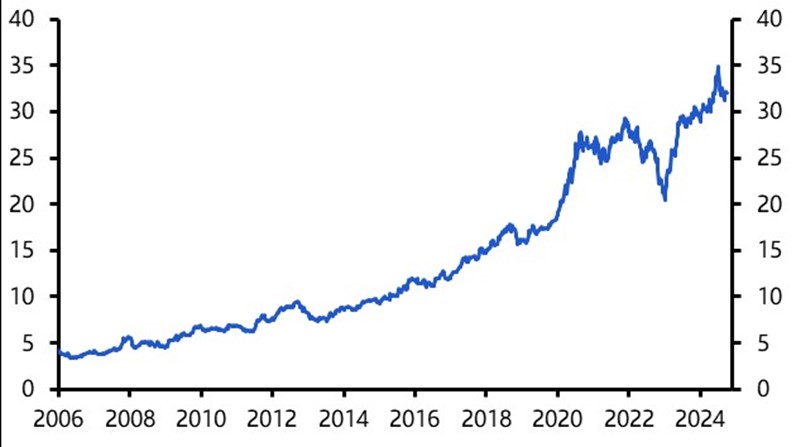

The chart below from Capital Economics highlights the narrowness of the rally by illustrating the percentage of the S&P 500 capitalisation from the top seven companies, illustrating the concentration of the rally from the Magnificent Seven.

Source: Capital Economics

We always argue that the market is right. It does what it does, and it has continued to rally in October.

During October we hosted a webinar with global strategist Viktor Shvets who discussed the replacement of economic cycles with business cycles. Viktor provided an outstanding geopolitical background, as well as fiscal and monetary policy implications and the potential impacts on investment markets.

One of the key takeaways from this webinar is the continued importance of stock selection over investment style (such as value or growth). This stock selection is dependent on productivity at a business level, combined with what Viktor referred to as circular drivers or themes such as AI or Streaming to name two.

As we enter the final two months of 2024, we have seen the first rate cut in the US, but we expect the US Federal Reserve (The Fed), and its global colleagues (apart from the RBA) to cut further in 2024.

Global Central Banks are doing this from a position of strength as inflation is under control and trending downwards, which is not the case in Australia.

There are risks, particularly in the US if the Fed does not cut interest rates at the pace that the markets are expecting or if earnings do not meet the consensus that is also priced in. We have stated many times that this is why we diversify, and whilst we are optimists, we always need to look at the risks and how elevated they may be.

Many will be reading this after the result of the US election. After such a strong rally, expect some volatility in the short term around the result, however, remember markets will not see this as a material driver in the medium to long term.

Our final discussion point is the massive stimulus announced in China. Whilst we are underweight China and as a medium to long term view extremely comfortable with this position, despite the strong rally, we see their stimulus as reducing the downside in areas external to China, such as providing a floor to what has been a weak iron price for example.

Whilst the bears and those that have not participated well in this rally are ringing the bell loudly on the dangers, we do want to reiterate a well-used term, “Don’t fight the Fed”.

The Fed has and will continue to cut. The direction is what investors are focusing on and that is lower interest rates, and this is from a position of strength, as there has not been a recession. Reduced interest rates or looser monetary policy leads to higher economic growth.

Why we call it a “hated rally” is that many were calling for a recession whereas an orderly slowdown is what has occurred. We stick to our soft-landing projection and 1:5 chance of a recession materializing in the US.

The last thought which we have often warned about in these pages is complacency. Always be careful of this and carefully balance fear over greed. Last October, as the market was bottoming out, fear had taken over. Greed is not prevalent currently, but we are looking out for it, and we will be active on asset allocation and diversification to produce balanced risk adjusted returns.

General Advice Warning

This investor insight and related content are provided for general informational purposes only by Hamilton Wealth Partners Pty Ltd (ABN 84155674043, AFSL 440046) and do not take into account the specific financial situation, investment objectives, or needs of any individual. They should not be relied upon as a substitute for specific financial, legal, or tax advice. Past performance is not indicative of future performance, and all investments carry risks, including loss of principal.

Before acting on any information contained within this insight, individuals should consider its appropriateness in light of their financial situation, consult a licensed financial adviser, and review the product disclosure statement and other relevant documentation. Hamilton Wealth Partners Pty Ltd expressly disclaims all liability for any loss or damage arising from reliance upon any information within this publication.

Login to …