Markets spent the first three weeks in February pulling back in an orderly fashion, something we felt was extremely healthy after the strong rally of the prior two months in global equity markets.

All that ceased on the 21st of February when Nvidia released their quarterly results in the US. The results were accompanied by bullish commentary from Nvidia’s CEO, who stated that a “tipping point” has arrived in the AI (Artificial Intelligence) boom.

This resulted in a fresh rally for the Dow Jones and the S&P500, pushing them to new all-time highs.

What is even more staggering is that on the 22nd of February, Nvidia rallied 16.4 per cent to USD785 per share, creating a tail wind for equity markets that we believe will continue to broaden beyond the large technology companies.

This rally in Nvidia added USD277Billion to its market capitalisation in one day (the largest increase in market capitalisation by a company in a single day), and in less than two months Nvidia has increased its market capitalisation by over USD700Bln in 2024 to USD1.94 trillion. To put this in perspective, the entire ASX was capitalized at 1.75 trillion as at the 31st of January 2024.

We continue to believe that AI is for real. Capital Economics in London said back in September last year that AI appears to have all the “characteristics of a general – purpose technology that will revolutionise economies and has the potential to deliver a substantial boost to productivity growth.”

Capital Economics went on to forecast that those economies that adopt AI successfully will see a boost to productivity of as much as 1.5 per cent per annum over the next decade. This will be led by the US, Korea and Singapore with Germany, France and Italy being the three laggards.

AI is creating a tail wind for markets. Capital Economics concedes that the valuation differential between the US and other developed market equity markets is wide, and it can be argued that US valuations are inflated. AI has, however, created momentum and they do not see these inflated valuations bursting for the next few years.

This may raise eyebrows with many readers, but the facts are that these AI related companies are growing earnings. It is not just about revenue, as we experienced in the 2000s. It is important therefore to concentrate on those companies with growing earnings that are providers of AI or direct beneficiaries, such as consultancy companies.

On the downside, Capital Economics expects a “modest and gradual rise in equilibrium real interest rates,” which will underpin higher bond yields than we have experienced over the last decade. The days of ultra-low interest rates are over.

Higher bond yields impact equity market valuations, but Capital Economics can see equities benefitting more from AI, on the back of economic and corporate earnings growth.

We felt it was important to put AI into context as the bottom line is that it is a major driver of markets currently.

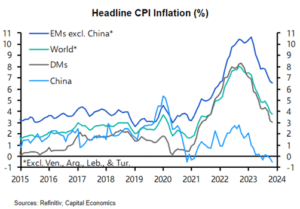

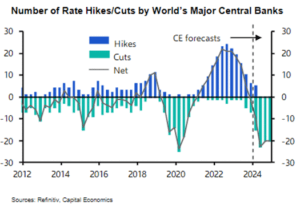

We continue to support equity markets more broadly, on the back of inflation coming under control, as illustrated in the first table below, and interest rates coming down, as per the second table showing expectations of central bank interest rate cuts.

As inflation has fallen, real interest rates have risen, and one could argue that monetary policy is now restrictive as a result. The bottom line is interest rates must decrease from these levels. The exception is Australia, where real interest rates are less restrictive, as we did not increase the nominal cash rate by as much as other developed economies, and inflation is not decreasing at the same rate as in other developed economies.

Interest rates have a major effect on equity markets. We believe that the US will start lowering interest rates in the second quarter and will cut rates another three to four times this year. This will underpin equity market performance and justify our optimism towards risk-based assets in 2024.

Login to …