As with every year it is important that as a firm, we hold ourselves to account in our published views and our performance throughout the year.

As we approach the end of 2023 it is time to reflect on the year that has been (in January 2024 we will publish our views and outlook for the year ahead).

HWP has been in existence for over a decade and our mandate is to “keep wealthy people wealthy”. The discipline of reviewing our investment decisions and holding ourselves to account is important.

In January 2023 we published our Investor Insight 117, The Year Ahead, we projected a theme of “when patience will be rewarded”, expecting an opportunity to increase risk-based exposure.

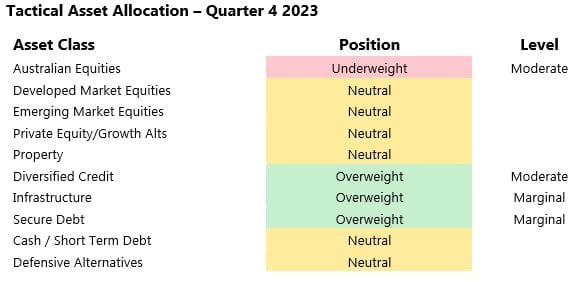

We entered 2023 underweight Developed Market equities and neutral all other risk-based assets. As we end 2023, we are underweight Australian equities and marginally overweight investment grade credit and Infrastructure, with all other risk-based assets held at neutral, as depicted below.

The level of global GDP growth has surprised markets, we expect global GDP to finish the year around 3.2 per cent. This is impressive considering the tight fiscal stance of major global economies.

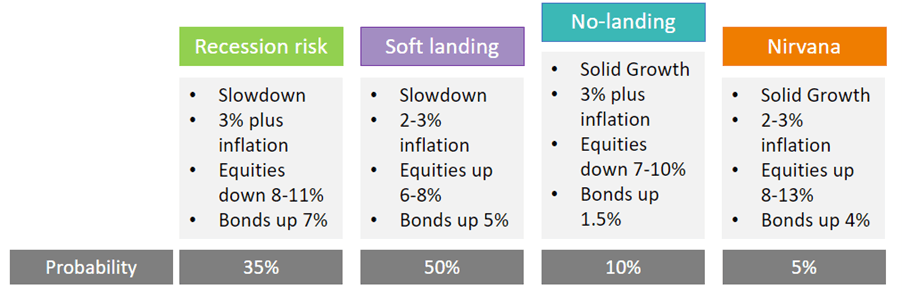

Looking forward we see the following possible macroeconomic scenarios, with the respective probability noted below.

Source: Hamilton Wealth Partners, Zenith Investment Partners

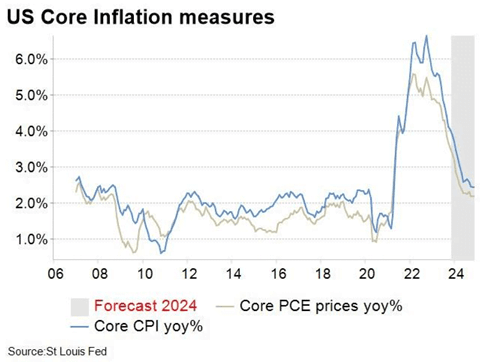

We expect inflation will fall towards central bank targets next year and the next chart illustrates that inflation is retracing at a manageable level.

The lagged effect of higher interest rates will become evident in the first quarter of 2024, leading to a slowdown in growth and the possibility of either a soft landing or mild recession both domestically and globally.

Interest rates will therefore decrease throughout 2024 but not to the extent that we projected earlier this year. This will lead to a decrease in bond yields as they have a mild rally, and an equity market rally in 2024 but again to a mild extent.

Uncertainty remains as we enter 2024, this is reflected in the lack of consensus about what lies ahead. Whilst we take a more moderate view on inflation and interest rates and a low probability of a “no landing” scenario, there are many out there who disagree but also remain bullish on equities. A “no landing” outcome is dreadful for both equities and bonds and an outcome we give a low probability.

The surprise of 2023 was the US led rally in the NASDAQ, centered around seven stocks and Artificial Intelligence (AI). The technology sector in the US had oversold in 2022 but also rallied too aggressively in 2023, and the late September/October pullback was not a surprise.

The rally and pullback illustrate the current disparity in views and markets have behaved in a bi-polar fashion. When the market rallied in the middle of this year exuberance took over and many could not see any downside, likewise the pullback in October saw real fear take over.

Investors must look through the noise and focus on fundamentals as we believe the volatility of 2023 will remain into 2024, equity markets exposure will be rewarded.

Fixed Income

We commenced the year with a Neutral position, having introduced duration to our portfolios for the first time in many years, with marginal additions to duration over the year. We had forecast further rate hikes as central banks were determined to reduce inflation, and for the yield curve to invert further as recessions became more likely as a result.

Both of these events occurred, the Fed Funds rate being raised from 4.50% at the start of the year to 5.5% now and the RBA cash rate rising from 3.10% at the start of the year to 4.35% now. The US 2yr-10yr yield curve inverted from -40 basis points at the start of the year to -110 basis points by mid-year as recession fears took hold.

What surprised us was the resilience of the US economy in the face of these rapid interest rate increases. Unemployment has remained very low, and growth has remained relatively firm. NAB expects US GDP growth of 2.4% for 2023. The yield curve inversion started to unwind in the second half of the year as recession fears subsided and, whilst we still believe it is valid to have some duration in bond portfolios, this is more for its defensive characteristics than because we see a significant fall in bond yields on the horizon.

Bond yields will fall as growth slows and interest rate expectations move lower, but they will not fall to the extent that a recession would have implied. We end the year with a marginal overweight to Fixed Income as a result.

Equities

Early in 2023 we decreased Australian Equities to underweight which we believe was the correct call. In the middle of the year, we also neutralised our developed market position with an underweight bias to the US and overweight midcaps.

Our underweight to the US, driven by the concentration of the rally in the NASDAQ in the first half of 2023, as illustrated in the chart below, turned out to be the incorrect call.

Source: Capital Economics

We see opportunity in global midcaps looking forward, that is companies with $10-30B market capitalisation. The valuation differential relative to large caps and in particular large cap growth stocks is compelling.

Source: Bell Asset Management

Our neutral position to Emerging Markets (EM) was a correct call considering our strong bias is away from China, and as such has produced solid returns.

In looking at EM, we have favoured active managerst with a focus on sovereign risk, limiting downside participation and winning by not losing. This focus has produced sound results for us over the last decade.

We end the year with a small underweight to Australian equities and Neutral Developed and Emerging Market Equities.

Property

Our view in late 2022 was that unlisted property would adjust lower to reflect the falls we had witnessed in listed property markets. Transactions have remained subdued for most of the year, although activity has lifted as we approach the end of calendar year. Our decision during the year to exit those unlisted property holdings with liquidity has reduced our downside participation, as unlisted property valuations have fallen to reflect the higher for longer interest rate environment that we are now in.

We have completed due diligence on several unlisted property deals in the commercial/office space in recent months and although the return metrics have increased substantially since 2022, due mostly to lower entry prices, we believe it is still too early to lock capital away for long periods of time in unlisted office assets. Where we have participated in unlisted property is in the industrial space, with these deals supported by better valuations, record low vacancy rates and long-term growth drivers.

A neutral position in Property has been the correct call, noting our comments above regarding reducing illiquid property where possible. We remain neutral Property as we approach the end of the year.

Alternative Assets

Over the decade we have slowly increased our positions across the sub asset classes of diversified credit, private equity, and infrastructure.

A neutral position has been the correct call this year as unlisted infrastructure has produced results, private equity has been a positive however with lower returns than historically delivered, and we have been cautious with diversified credit, favouring only senior secured solutions.

We have ensured that risk within this asset class is managed by focusing on diversification within sub asset classes and amongst asset classes and vintages.

There is a trend in wealth management known as the “democratization” of private assets which we think is misplaced and dangerous, particularly in the structure and quality of some offerings.

Our portfolios saw returns enhanced through these asset classes in 2023, reducing portfolio volatility, we remain neutrally positioned as we end 2023.

Summary

Like 2022, 2023 has been exceptional.

As we close out 2023, we are neutral risk-based assets, led through an underweight in Australian equities and overweight in investment grade credit.

We have increased our bond/fixed income exposure through the year, but we believe we will exit these positions earlier than expected on any rally, as the risk/reward equation will then favour a conservative diversified credit exposure over the volatility of bonds.

As we have mentioned in these pages previously, we must be careful not to become anchored to the environment we are in, or how the latest markets and performance affect us.

When we are in a bear market, it can feel like it will last forever; similarly, a market that is booming, and that has been evident at times during 2023.

Risk should be rewarded medium term over defensive, but through a conservative lens, as we believe our mandate is to keep wealthy people wealthy.

Successful investors never forget risk as a key component of strategy and the need for prudent risk management. Looking towards 2024, we are attempting to expose portfolios to risk exposure upside through equities and alternative assets whilst balancing risk in portfolio construction.

At HWP, we will continue to always position client portfolios for a full market cycle, not being distracted by short term noise. Underlying asset valuations and credit quality are important to consider and asset allocation is the most crucial decision an investor can make, and investors who are bold when markets are out of line with valuations will achieve the best results.

Login to …